Checking Accounts

Whether you're a teen looking to deposit a paycheck or a college student that needs to manage bills & track spending, we have the checking account for you. If you're over 18 you can open one yourself or, if you're still under 18, use a parent or guardian as a joint owner.

Rewards Checking

Earn 5% cash back on your monthly debit card purchases, up to $10 every month. It's just $25 to open and has no minimum balance or monthly service charges.

High Interest Checking

Let your money work for you with an account that earns 2.01% APY* on balances up to $25,000. Open one for as little as $25, plus no minimum balance or monthly service charges.

Stock Rewards Checking

Start investing small by redeeming your rewards for fractional shares of popular stocks with this innovative account. Requires a $5 monthly service charge and brokerage account with rewards partner Bits of Stock.

Savings Accounts

Saving for college, a car, or just money to help you in the next stage of life? We have savings account options perfect for teens and young adults. If you're over 18 you can open one yourself or, if you're still under 18, use a parent or guardian as a joint owner.

What to Know About Saving

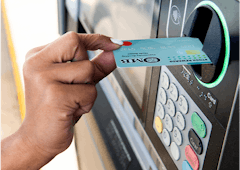

Debit Card Benefits

Find 24/7 access to surcharge-free ATMs nationwide via the MoneyPass® network. Free for any OMB customer with a personal checking account.

- Unlimited ATM withdrawals at any OMB or MoneyPass® ATM

- Easily manage with our secure mobile apps

- Register your card with Mastercard® SecureCode™ for added shopping security

Auto Loans: The Basics

Plan for Anything

Our 40+ free financial calculators can help you finesse your budget, compare borrowing costs, forecast earnings and so much more.

Common Financial Terms & Their Definitions

- Income: Money earned from working

- Expense: Anything that costs money

- Budget: A financial plan that breaks down how much to spend or save in a set time frame by category

- Interest: Money earned on an accumulated balance (i.e. interest earned on a savings account) or money paid to finance a purchase (i.e. monthly interest payment on a car loan)

- Credit: Money loaned to use now that must be paid back later

- Maturity: The date on which the balance of something becomes due and the principal plus interest becomes payable

- Mortgage: A loan used to buy property

- Taxes: Fees paid to the government by individuals and businesses to fund public programs and government spending

- Inflation: The rise in prices of goods and services over time; as inflation increases, purchasing power (how far money will go) decreases

- Asset: Something owned, such as the money in a bank account or a house

- Liability: Any debt that must be paid

MONEY TIPS

8 Important Questions to Ask Before Taking on Debt

Unsure if you should save and buy outright or finance a purchase? Here are useful tips to help you decide.

How to Decorate Like a Pro as a Renter

Regardless of your age or life stage, most of us rent at some point in our lives. Learn how to decorate like a pro without breaking your lease, or the bank.

Impulse Spending: What It Is and How to Combat It

Impulse buying is among the quickest ways to drain your wallet. Here’s an examination of some of the psychology behind it and suggestions on how you can curb the mindless spend.

Harness the Power of Mobile Banking

OMB's industry-leading mobile banking app puts you in control of your finances in powerful new ways. Check balances, transfer funds, pay bills, deposit checks, even chat live with our friendly staff directly in the app. With enhanced digital banking features and online security, you'll wonder how you ever lived without it. Download it now!

Your 24/7 Personal Digital Branch

Payments are fast, safe and easy thanks to Zelle®. Pay your family and friends or request money regardless of where they bank.