Identity Theft

What is identity theft?

Identity theft occurs when someone acquires your personal information and uses it without your knowledge to commit fraud or theft. It is a serious crime and cases are growing. An all-too-common example is when an identity thief uses your personal information to open a credit card account in your name.

No matter how cautious you are, there is no way to completely prevent identity theft from occurring. But there are ways you can help minimize your risk. This page contains valuable information on how you can protect yourself by managing your personal information wisely, the warning signs of identity theft, and what to do if you do become a victim.

Helpful Tips

- Don't give out personal information on the phone, through the mail or over the Internet unless you've initiated the contact or are sure you know whom you're dealing with.

- Don't carry your Social Security card with you; leave it in a secure place. Carry only the identification and credit and debit cards that you need.

- Don't put your address, phone number, or driver’s license number on credit card sales receipts.

- Social Security numbers or phone numbers should not be put on your checks.

- Shred your charge receipts, copies of credit applications, insurance forms, physician statements, checks and bank statements, expired charge cards that you're discarding, and credit offers you get in the mail. Utilize a shredder with cross-cut or better technology.

- Secure your credit card, bank, and phone accounts with passwords. Avoid using easily available information like birth date, the last four digits of your SSN, or your phone number. When opening new accounts, you may find that many businesses still have a line on their applications for your mother's maiden name. Use a password instead. Sentences with capitals, punctuation, and numbers make great passwords that are hard to break and easy to remember.

- Secure personal information in your home, particularly if you have roommates or hire outside help.

- Promptly remove mail from your mailbox. If you're planning to be away from home and can't pick up your mail, call the U.S. Postal Service at 1-800-275-8777 to request a vacation hold.

- Ask about information security procedures in your workplace. Find out who has access to your personal information and verify that records are kept in a secure location. Ask about the disposal procedures for those records as well.

- Before revealing any personally identifying information (for example, on an application), find out how it will be used and secured, and whether it will be shared with others. Ask if you have a choice about the use of your information. Can you choose to have it kept confidential?

Your Security Is Our Top Priority

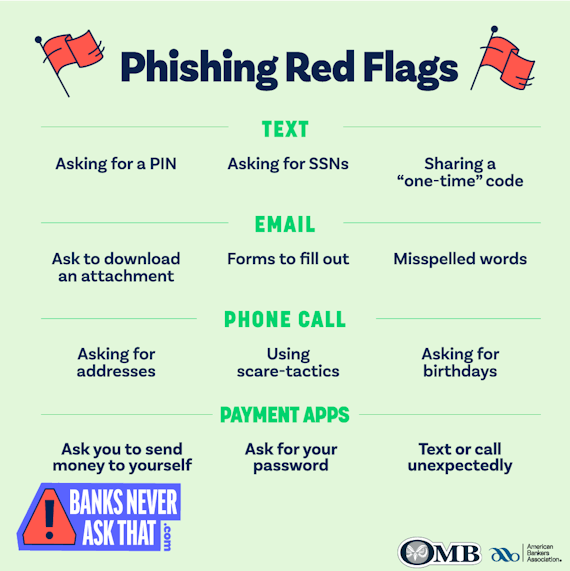

#BanksNeverAskThat

Learn to spot the red flags so you don't fall victim.

Phishing, fraud, and scams are on the rise. There are some things your bank will NEVER ask you. That's why we've partnered with the American Bankers Association and their #BanksNeverAskThat campaign.

Phishing

Phishing usually comes in the form of fraudulent emails that appear to come from legitimate sources. These ask customers to verify personal information or link to counterfeit Web sites that appear real.

Watch for emails that:

- Urge you to act quickly because your account may be suspended or closed, or to update your personal information.

- Don't address you by name, but use a more generic one like "Dear valued customer."

- Ask for account numbers, passwords, Access IDs, or other personal information.

OMB will NEVER ask for sensitive information, such as account numbers, access IDs or passwords, via e-mail.

Tips from the American Bankers Association for safeguarding your information:

- Do not give your Social Security number or other personal credit information about yourself to anyone who calls you.

- Tear up receipts, bank statements and unused credit card offers before throwing them away.

- Keep an eye out for any missing mail.

- Do not mail bills from your own mailbox with the flag up.

- Review your monthly accounts regularly for any unauthorized charges.

- Order copies of your credit report once a year to ensure accuracy. You may call 1-877-322-8228 for a free credit report from any or all three credit reporting agencies.

- Do business with companies you know are reputable, particularly online.

- Do not open email from unknown sources and use virus detection software.

- Protect your PINs (don’t carry them in your wallet!) and passwords; use a combination of letters and numbers for your passwords and change them periodically.

- Report any suspected fraud to your bank and the fraud units of the three credit reporting agencies immediately.

If you become a victim, contact:

- The fraud departments of the three major credit reporting agencies

- The creditors of any accounts that have been misused

- The local police to file a report

- OMB Bank to cancel existing accounts held in your name and re-open new accounts with new passwords

OMB is committed to safeguarding our customers’ financial information. Maintaining our customers’ trust and confidence is a top priority. To learn more about how we protect your information, you may view our privacy policy.

Never Share Your PIN or Password

Camping is fun. Getting scammed, not so much.

Check out this video and learn the do's and don'ts when someone contacts you and asks for your online banking logins.

Your Credit Report

Check your credit report, either online or order copies of your credit report once a year to ensure accuracy. You may call 1-877-322-8228 or visit Annual Credit Report for a FREE credit report from any or all three credit reporting agencies. (The law allows credit bureaus to charge you up to $9.00 for an additional copy of your credit report.)

Make sure it is accurate and includes only those activities you have authorized.

By checking your report on a regular basis you can catch mistakes and fraud before they wreak havoc on your personal finances. Don't underestimate the importance of this step.

Credit Bureaus

Equifax

To order your report, call: 1-800-685-1111

To report fraud, call: 1-800-525-6285

Experian

To order your credit report or report fraud, call: 1-888-EXPERIAN (397-3742)

TransUnion

To order your report, call: 800-916-8800

To report fraud, call: 1-800-680-7289